Mississippi’s defined benefit pension system is in much better financial shape than last year, according to data from the plan’s actuary.

The Board of Trustees for the Public Employees’ Retirement System of Mississippi meet Tuesday and the plan’s actuaries, Cavanaugh Macdonald Consulting, told the board that the 32.3 percent rate of return from the plan’s investments last year will help it recover its financial footing and improve their future outlook.

PERS, which is the retirement plan for most state and local employees, is lowering some assumptions at the suggestion of their actuaries. The expected rate of return assumption for the plan’s investments (61 percent of which are in U.S. and international stock markets) has been lowered from 7.75 percent to 7.55 percent. The price inflation assumption was lowered from 2.75 percent to 2.4 percent, along with age inflation (assumption dropped from 3 percent to 2.65 percent).

They predict that the plan will be 93.8 percent fully funded by 2047, which is much better than last year, when they predicted after measly 3 percent returns that figure would be 67.6 percent.

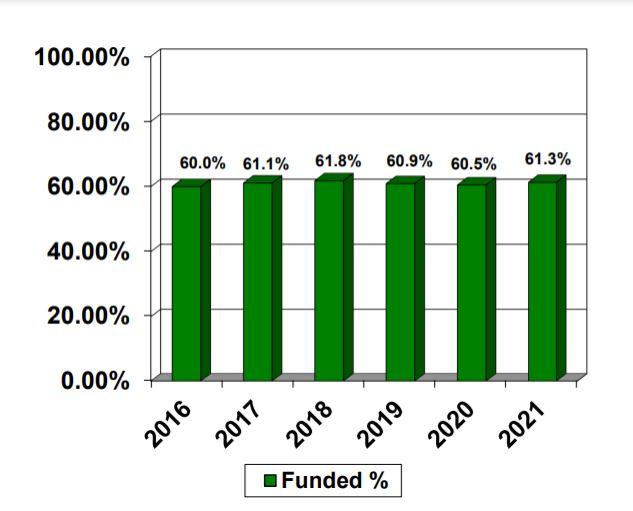

The actuaries also project that in the short-term, the plan’s 61.3 percent funding ratio (which is defined as the share of future obligations covered by current assets) will increase even more as the massive windfall is smoothed over the next five years. That smoothing will decrease this year’s rate of return to 12.5 percent.

By 2024, the actuary predicts the plan will be 69 percent fully funded and two years later, 72.4 percent fully funded.

More importantly, the plan’s amortization rate (the time it takes to pay off the plan’s presently unfunded liabilities) will shrink by 17 years in 2023.

The 61.3 percent funding ratio is the best the plan has seen since 2018, when it was 61.8 percent fully funded. The plan has been in the 60 percent range since 2014 (with two years in the high 50 percent range in 2012 and 2013) and was 87.5 percent fully funded as long ago as 2001.

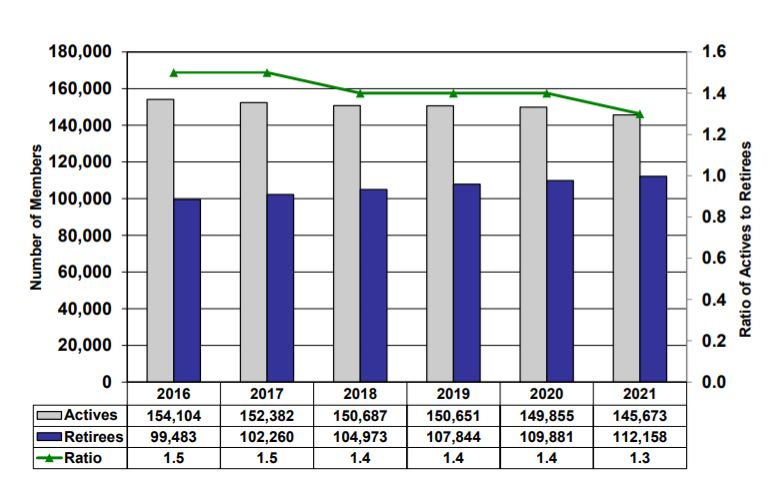

The number of retirees is up from last year (112,158 in 2021 vs. 109,881 in 2020) while the number of contributing employees is down (145,673 in 2021 vs. 149,855 in 2020). That represents a 2.07 percent increase in the number of retirees while the number of contributing employees fell by 2.79 percent.

This is also reflected in payroll and benefits, as the amount of payroll dipped slightly (0.65 percent or $6.287 billion in 2021 vs. $6.246 billion in 2020). The amount of benefits paid jumped 3.79 percent from $2.9 billion in 2020 to nearly $3.1 billion in 2021.

All three of the other pension funds — the Mississippi Highway Safety Patrol Retirement System, the Supplemental Legislative Retirement System (which is in addition to their PERS benefits) and the Municipal Retirement Systems had their net positions improve as well thanks to the strong year with investment returns.

The MHSPRS had its funding ratio increase from 66.5 percent to 70.4 percent in 2021 and it is projected by the actuaries to be 128.5 percent fully funded by 2042. SLRP has a funding ratio of 78.7 percent and is projected to be 129.8 percent fully funded by 2042.

The MRS is a combination of the old pension funds of several cities that predate the formation of PERS and is managed by PERS officials. The final two contributing employees in the MRS retired in 2020 and the number of retirees has shrunk from 1,798 in 2016 to 1,486 in December 2021. The participating cities use property tax millage to pay for the more than $30 million in benefits the plan paid to beneficiaries in 2021.

Most of these retirees (500) are in Jackson, for which more than $10.9 million in benefits were paid in 2021.

The board also approved a motion that would seek recovery of $119,800 in delinquent contributions from the Southwest Mississippi Behavioral Health Center.